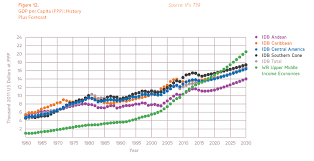

The retail analytics market is growing at a rapid rate. As per a report by Research and Markets, the global retail analytics market is expected to grow at a rate of 18% from 2019 to 2025 and will be valued at over $9.5 billion in five years. Multiple factors are driving this growth which includes adopting cloud-based software, IoT, and even AI-driven solutions. Since data and analytics are an integral part of these technologies, it allows businesses to have information at their fingertips.

As per a report by Gartner, a whopping 90% of corporate strategies consider information as a critical enterprise asset and analytics as an essential competency. Companies are investing more in this space and consider data and analytics as a solution to gain a competitive edge over others in the market.

Nowadays, customers are more empowered and connected than ever before and it is becoming increasingly important for companies to obtain insight into customer buying behavior. Analytics employs various tools to understand consumer buying habits to accurately predict their future buying preferences. This helps businesses to attract, rather than alienate consumers.

Data has gradually become a touch point for most retailers to understand customer needs and wants. To derive meaningful insights, data must be presented in a user-friendly way, and give you the ability to study this information and gain insights into what your business needs to not just survive, but thrive.

How can you accomplish that?

TraQiQ offers a range of business intelligence and analytics solutions that can help you see beyond raw data. Our experts work with a variety of third-party tools to help with data preparation, mining, management, and visualization. TraQiQ can help in building the right dashboards for AI-based decision-making tools or build real-time systems that monitor data feeds. Insights from this data can be used to improve customer experience, resulting in better business operations, and provide the right target audience for marketing initiatives.