If you’re in e-commerce, like fashion or groceries, you probably know the value of consumer retention. Therefore, customer acquisition is a constant battle. Providing exceptional service during the initial engagement is very important. For continued growth, long-term relationships with customers must also be considered.

Here, you can discuss customer retention. It is the art of keeping existing clients satisfied & coming back for future needs. Hence, it is the cornerstone of a thriving professional services practice.

Let’s explore the importance of customer retention for e-commerce. Here, you will find some effective after-sales service strategies that ensure loyalty & repeat business.

Building Strong Customer Relationships Key to Successful After Sales Retention Strategies

Think of your ideal customer not as a transaction but as a valued guest. Here’s how to build strong relationships that keep them coming back for more:

Personalized Onboarding

Ditch the boring welcome emails. Create a personalized craft for a VIP experience. This can also be a guided tour based on browsing history. A handwritten note is also required with the original order.

If you’ve ever sent your grandparents a thank you note for their cute holiday socks, you already know this gratitude effort. Getting an actual card in the mail is rare, so mailing one is special.

Sending postcards or notes doesn’t have to be complicated. Triggering “thank you” reminders in your business is another step in your automated sales process.

Dedicated Success Managers

Consider hiring dedicated customer success managers for high-priced customers or those who need extra support. This personal touch builds trust & creates a smooth shopping journey.

Regular check-ins & relationship checks

Don’t be a stranger to your consumer. Active conversations through surveys or emails show you care. Collect data on their satisfaction & identify areas for improvement.

Offer support services

Sometimes things don’t work out during a shopping trip. It happens to everyone. Make it easy for your clients to know how to get help when they find an issue.

You can provide them with multiple ways to get in touch. Different types of people want different solutions. For example, older customers are likely to call sales support & talk to a real person. While younger customers are likely to chat with a rep.

Seek feedback

Don’t be left in the dark about customer satisfaction. Send follow-up surveys with clear questions to find out how your customers feel about your brand. Plus, your product & get their suggestions for improvement.

Develop a clearly defined objective for each survey you send. So, you can ask the right questions. If you want to know how likely a consumer is to refer you to a friend, ask them questions about brand rating. Don’t ask how often they’d like to receive emails from you.

Providing exceptional service After Sales Strategies to satisfy e-commerce customers

Landing a sale from a new customer is one part of increasing revenue, however, it isn’t the whole story. To scale your business, you need to turn customers into repeat buyers.

As an eCommerce business owner, you must consider a few things. You should realize that delivering exceptional customer service is not only solving problems. Instead, it’s about creating memorable moments.

Prompt & responsive assistance

Provide multiple customer support channels, such as live chat, email, & phone. You need to ensure an adequate & efficient response. Simply put, aim for a first-class solution to communicate whenever possible.

Going the extra mile

Surprise & delight customers with unexpected crafts. For example, they could receive a free upgrade based on their purchase history. You can also add a personalized birthday discount or a handwritten thank-you note included with their order.

Proactive Problem-solving

Use purchase history & website behavior data to anticipate customer needs. Address potential issues proactively through order tracking updates or helpful content.

Effective Communication Increasing customer engagement with After Sales

Whether you run an actual e-commerce company or offer exclusive products to your clients, you already know that brand loyalty depends upon happy buyers and users.

Clear communication builds trust & keeps customers coming back for more. Here’s how to create a communication channel that resonates.

Clear & transparent methods

Make sure all communication channels – website content, confirmation orders, & marketing emails. Hence, they are easy to understand & informative.

Active listening & addressing concerns

Pay attention to customer feedback, good & bad. Actively listen to their concerns & act quickly to resolve them.

Timely updates about production & orders

Throughout the purchasing process, keep clients informed by giving them prompt updates, order confirmations, & explicit return & exchange guidelines.

Customizing products & After Sales services Modifying the supply chain to meet customer needs

Recognise client demands & provide goods & services that meet them. Here’s how you can alter the buying encounter:

Researching customers

Gather input on a regular basis by using questionnaires & surveys. You may better understand consumer preferences & pinpoint areas for development with the use of this useful data.

Personal product recommendations

Use web browsing data & purchase history to recommend products that are likely to appeal to individual customers, creating a more relevant & enjoyable shopping experience.

Implement a Loyalty Program

A thoughtfully created e-commerce reward program can encourage recurring purchases & cultivate a devoted consumer base. Customers that regularly support your brand should receive prizes, discounts, gamification, or special incentives.

Loyalty programs can convert inexperienced customers into devoted brand ambassadors & promote client retention.

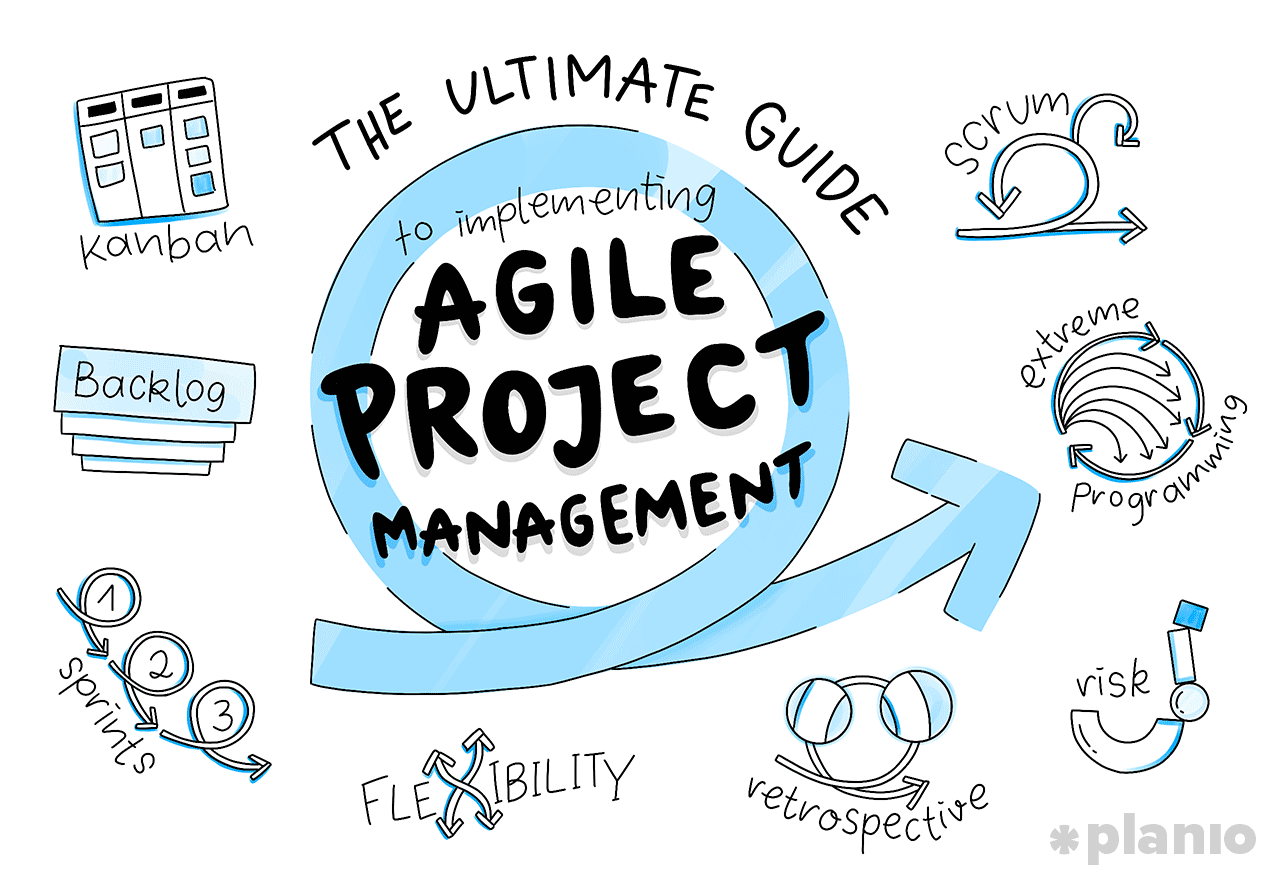

Leveraging Technology Enhancing the E-commerce After Sales Customer Experience

For businesses, leveraging technology is crucial in enhancing the customer experience & staying competitive in a rapidly evolving marketplace.

It plays a vital role in crafting a user-friendly & efficient shopping experience. Here are some key features of technologies like TraQSuite to employ:

User-friendly Website Design & Navigation

It ensures your website is easy to navigate. Also, it has a clear layout, fast loading times, & is mobile-responsive.

Personalized Support Features

Implement features like order tracking with real-time updates, wish lists, & saved shopping carts. These features enhance user experience & encourage repeat visits.

CRM Systems & Data-driven Insights

TraQSuite utilizes a Customer Relationship Management system to centralize customer data & gain valuable insights. Use this data to create personalized marketing campaigns & offer specific customer segments.

Active participation in information processing

It sends automatic email or SMS notifications to alert customers to abandoned carts, returned packages, or recommended individual products.

Monitoring & feedback Using metrics & customer input to improve After Sales retention efforts

Proper conservation requires ongoing monitoring & improvement. Here’s how to analyze your efforts & make data-driven decisions:

Customer Satisfaction Metrics & NPS

Track customer satisfaction scores & NPS metrics to gauge customer sentiment over time.

Regular review of customer feedback

Conduct regular customer feedback surveys to gather specific insights into what your customers like & dislike about your brand.

Customer retention rates & trend analysis

Track your company’s customer retention rates. Additionally, look for trends to pinpoint clients who are at risk & create plans for recovery.

Conclusion Using Robust After-Sale Techniques in E-commerce

Any business must prioritize satisfying its customers. But it appears to be the most potent force in the e-commerce industry.

You may convert one-time salesmen into potential advocates who publicly promote your brand by dominating the after-sales industry.

Moreover, technology is a powerful ally in delivering exceptional after-sales service. Simplify your process by using our advanced consumer relationship management software, TraQSuite.

TraQSuite offers features such as automated communication workflows, data-driven reporting, & centralized client information management. Hence, our software empowers you to deliver a seamless after-sales experience that strengthens client relationships & drives sustainable success.