How Can a Cash Management System Transform Your Business? Exploring the Benefits in 2024

In today’s competitive business environment, managing your cash flow effectively is crucial for survival and growth. A robust cash management system (CMS) can be a game-changer, offering a wide range of benefits that can significantly improve your financial health.

This blog delves into the key advantages of implementing a cash management system in your business, highlighting how it can streamline operations, boost efficiency, and ultimately, empower you to make informed financial decisions.

1. Enhanced Visibility and Control

One of the most significant advantages of a cash management system is the real-time visibility it provides into your cash flow. Gone are the days of manually sifting through spreadsheets and bank statements. With a cash management system, you can access critical information like account balances, incoming and outgoing transactions, and upcoming payments.

This transparency allows you to:

- Forecast cash flow accurately

By analyzing historical data and trends, you can predict future inflows and outflows with greater accuracy. This enables you to plan for upcoming expenses, identify potential shortfalls, and make proactive decisions to maintain sufficient liquidity.

- Identify spending patterns

A cash management system helps you gain valuable insights into your spending habits. You can easily categorize expenses, track specific cost centers, and identify areas where you can optimize your budget and control unnecessary expenditure.

- Monitor cash flow in real-time

Having a holistic view of your cash flow allows you to make informed decisions on the fly. You can prioritize payments, negotiate payment terms with vendors, and optimize your cash position to maximize your financial resources.

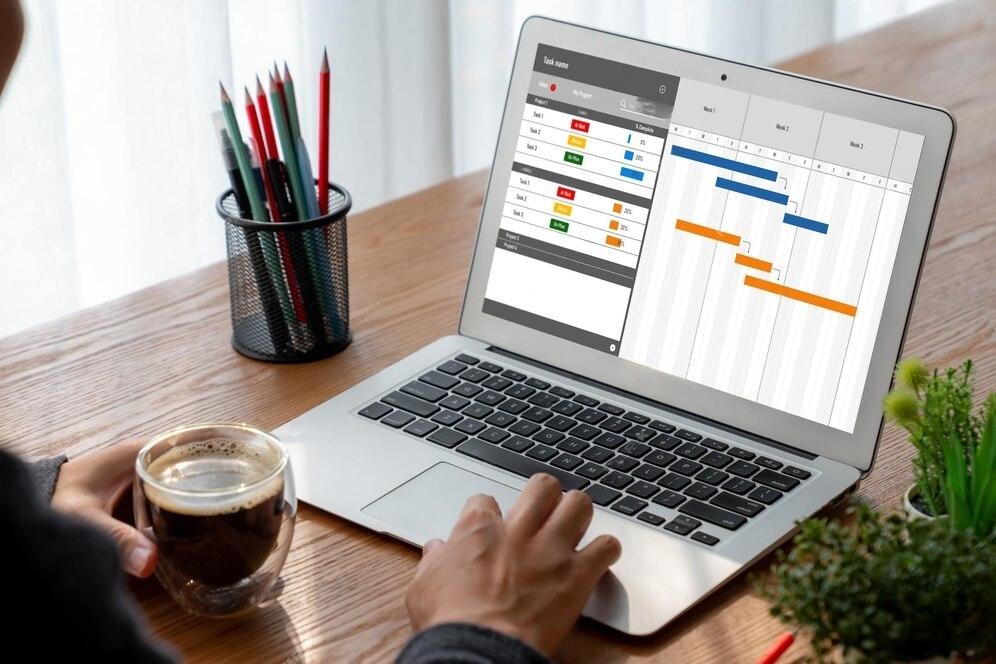

2. Streamlined Operations and Improved Efficiency

Manual cash management processes can be time-consuming, prone to errors, and inefficient. A cash management system automates several tedious tasks, freeing up valuable time and resources that can be better utilized for core business activities.

Here’s how a cash management system streamlines operations:

- Automated payments and collections

Schedule recurring payments and invoices, eliminate the need for manual data entry, and reduce the risk of late fees or missed payments.

- Reconciliation simplified

Streamline the bank reconciliation process by automatically matching transactions with bank statements, saving you significant time and effort.

- Improved communication and collaboration

A centralized platform facilitates seamless communication and collaboration between finance teams and other departments, ensuring everyone is on the same page regarding financial matters.

3. Reduced Costs and Increased Profitability

By optimizing your cash flow and automating tasks, a cash management system can significantly contribute to cost reduction and improved profitability.

Here are some potential cost-saving benefits:

- Reduced administrative costs

Eliminate manual data entry and streamline reconciliation processes, freeing up staff time for higher-value activities.

- Reduced late fees and penalties

Automated payments ensure timely processing, eliminating the risk of late fees and penalties associated with missed payments.

- Optimized interest income

Utilize idle cash more effectively by earning interest on short-term investments through the features offered by some cash management solutions.

- Improved decision-making

Data-driven insights enable better decision-making, leading to cost savings and improved resource allocation.

4. Enhanced Security and Reduced Fraud Risk

Managing cash manually poses security risks and increases the vulnerability to fraud. A cash management system can help mitigate these risks through features like:

- Access control

Implement user permissions and authorization protocols to restrict access to sensitive financial information.

- Audit trails

Track all financial activity with detailed audit logs, enabling you to identify and investigate any suspicious transactions.

- Fraudulent activity detection

Utilize built-in security features to detect anomalies and suspicious patterns that might indicate potentially fraudulent activity.

5. Improved Financial Reporting and Compliance

A CMS simplifies the process of gathering and compiling financial data, leading to:

- Enhanced reporting

Generate accurate and up-to-date financial reports quickly and easily, allowing you to gain insights into your financial performance and make informed decisions.

- Simplified compliance

Ensure regulatory compliance by automatically generating reports and maintaining detailed records of all financial transactions.

Conclusion: A Strategic Investment for Your Business

Investing in a cash management system is not just about managing your cash; it’s about gaining a strategic advantage.

By implementing a cash management system, you can:

- Empower data-driven decision-making

Gain real-time insights into your financial health and make informed decisions based on accurate data.

- Improve operational efficiency

Streamline processes, automate tasks, and free up valuable resources for core business activities.

- Enhance financial security

Mitigate risks associated with fraud and ensure compliance with regulations.

- Boost profitability

Optimize cash flow, reduce costs, and maximize your financial resources for growth.

In today’s competitive landscape, a robust cash management system can be a powerful tool for businesses of all sizes. Consider exploring a cash management solution and unlock the potential to significantly improve your financial health, efficiency, and ultimately, your long-term success.