In today’s competitive business landscape, customer satisfaction and loyalty are more crucial than ever. A significant aspect of achieving this is through effective after-sales service. Whether you’re in manufacturing, retail, or services, the ability to promptly address customer issues, provide technical support, and manage warranties and service contracts is paramount. This is where after-sales service software plays a pivotal role.

Why Is After-Sales Software Service Critical for Enhancing Customer Service Excellence, Business Success, and Loyalty?

Customer service, powered by effective after-sales service software, is a critical component that can make or break a business in today’s competitive landscape. It encompasses all interactions between a company and its customers, from initial inquiry to post-purchase support. The importance of customer service cannot be overstated as it directly impacts various aspects of a business’s success.

Firstly, outstanding customer service enhances customer satisfaction

When customers feel valued and their concerns are promptly addressed using after-sales service software, they are more likely to develop a positive perception of the brand. This positive experience not only encourages repeat purchases but also fosters customer loyalty. Loyal customers are invaluable assets to any business as they spend more over their lifetime and are more likely to recommend the brand to others.

Secondly, effective customer service plays a crucial role in reputation management.

In today’s digital age, customers have a powerful voice through social media and online reviews. A single negative customer experience can quickly escalate and tarnish a brand’s reputation. On the contrary, resolving issues promptly and courteously with the aid of after-sales service software can turn dissatisfied customers into loyal advocates who speak positively about their experiences, thereby enhancing the brand’s reputation.

Moreover, customer service contributes to business growth and profitability.

Satisfied customers are willing to spend more on products and services and are less price-sensitive compared to new customers. By focusing on retention through exceptional customer service enabled by after-sales service software, businesses can achieve sustainable growth and reduce the costs associated with acquiring new customers.

Lastly, customer service reflects a company's commitment to excellence and customer-centric values.

Businesses that prioritize customer service, leveraging after-sales service software, demonstrate their dedication to meeting and exceeding customer expectations. This commitment not only attracts new customers but also helps in retaining existing ones, creating a positive cycle of growth and success.

What Tech Innovations Are Redefining Customer Care Service Standards?

Technology in Customer Service:

- Revolutionizing interactions and support through advanced tools and channels.

- AI-driven chatbots provide instant responses to customer queries.

- Sophisticated CRM systems track and analyze customer interactions for personalized service.

Social Media Engagement:

- Platforms enable real-time responses to feedback and inquiries.

- Dynamic channels for proactive customer engagement and brand presence.

Self-Service Empowerment:

- Portals and knowledge bases allow customers to find solutions independently.

- Reducing reliance on traditional support channels, enhancing efficiency.

Impact on Business:

- Improved customer satisfaction through enhanced service capabilities.

- Boosted operational efficiency and cost reduction.

- Positioning businesses as customer-centric leaders in a tech-savvy market.

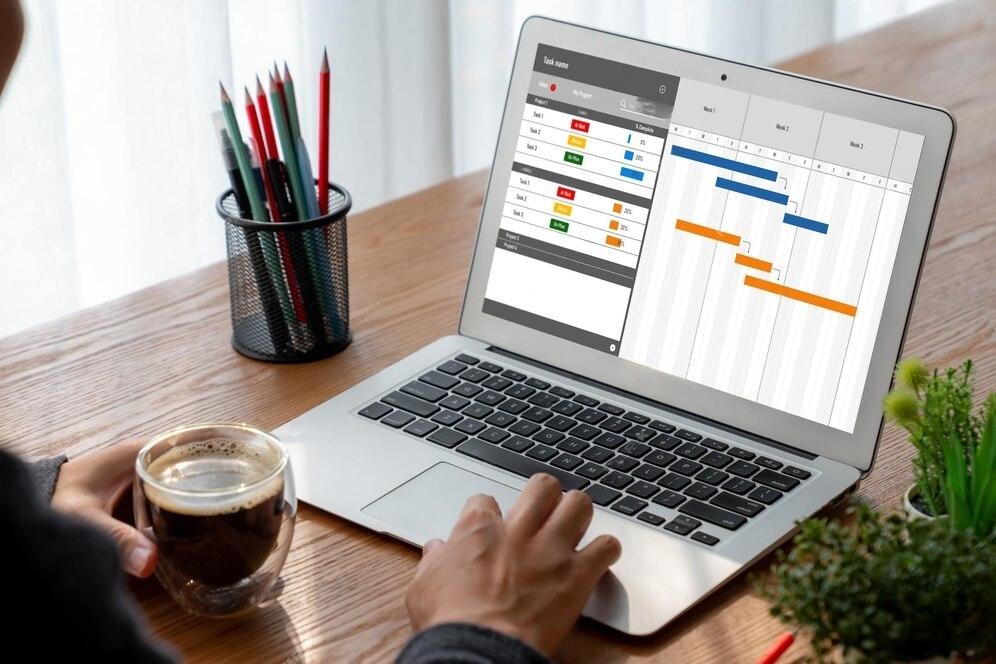

Mastering Service Dynamics: After-Sales Software Insights

After-sales service software refers to a suite of tools designed to streamline and enhance the post-sale customer experience. It encompasses functionalities such as:

Ticket Management: Handling customer queries, complaints, and requests through a centralized system.

Service Management: Managing service appointments, dispatching technicians, and tracking service delivery.

Warranty and Contract Management: Tracking warranty periods, managing service contracts, and automating renewals.

Knowledge Base: Providing self-service options with FAQs, troubleshooting guides, and instructional content.

Reporting and Analytics: Generating reports on service performance, customer satisfaction, and operational efficiency.

Software Success Secrets: Finding Your Perfect Fit

Choosing the right after-sales service software is critical for several reasons:

Enhanced Customer Experience: It enables prompt response times, personalized service, and seamless issue resolution, thereby enhancing overall customer satisfaction.

Operational Efficiency: Automation of service processes reduces manual errors, streamlines workflows, and improves the efficiency of service delivery.

Insightful Analytics: Data-driven insights help in identifying trends, improving service quality, and making informed business decisions.

Scalability: The software should accommodate your business’s growth and evolving needs, whether in terms of customer base, service offerings, or geographical expansion.

Integration Capabilities: Seamless integration with existing CRM, ERP, or other business systems ensures smooth data flow and holistic business operations.

Essential Features in an After-Sales Service Software

When evaluating after-sales service software, consider the following key features:

Ease of Use: Intuitive interface and user-friendly design for both agents and customers.

Customizability: Ability to customize workflows, ticket fields, and reporting dashboards to align with your business processes.

Mobile Accessibility: Support for mobile devices to empower field technicians and enable real-time updates.

Integration: Compatibility with existing systems such as CRM, ERP, and eCommerce platforms.

Automation: Automation of routine tasks like ticket routing, scheduling, and notifications to improve efficiency.

Analytics and Reporting: Robust reporting capabilities to track KPIs, measure performance metrics, and identify areas for improvement.

Analytics and Reporting: Robust reporting capabilities to track KPIs, measure performance metrics, and identify areas for improvement.

Crafting Your Customer Care Canvas: Steps to Software Selection

1. Assess Your Needs

Identify your specific after-sales service requirements, including the volume of service requests, types of services offered, and customer expectations.

2. Research and Compare

Conduct thorough research on available software options. Consider reading reviews, consulting industry experts, and attending demonstrations or webinars.

3. Evaluate Features

Create a checklist of desired features and functionalities. Prioritize those that align closely with your business objectives and operational workflows.

4. Consider Integration

Ensure compatibility with your existing systems to facilitate seamless data exchange and maintain a unified view of customer interactions.

5. Scalability and Flexibility

Choose a software solution that can scale with your business growth and adapt to changing market dynamics and customer expectations.

6. Budget and ROI

Evaluate the total cost of ownership, including implementation, training, and ongoing maintenance. Assess the potential return on investment (ROI) in efficiency and customer satisfaction.

7. User Experience

Prioritize software that offers a positive user experience for both internal users (agents, technicians) and external users (customers).

Success Stories Reimagined: Creative Use Cases

Use Case 1

Company XYZ, a leading electronics manufacturer, implemented after-sales service software to streamline their service operations. By integrating with their CRM system, they reduced response times by 30% and improved first-time fix rates by 20%. This resulted in a significant boost in customer satisfaction scores and repeat business.

Use Case 2

Service Provider ABC adopted after-sales service software to manage its nationwide service network. With mobile accessibility for technicians and automated dispatching, they achieved a 25% reduction in service delivery costs and increased service contract renewals by 15% within the first year of implementation.

Conclusion

Choosing the right after-sales service software is a strategic decision that can profoundly impact your business’s ability to deliver exceptional customer service and drive operational efficiency. By understanding your specific needs, evaluating key features, and considering integration capabilities and scalability, you can select a solution that not only meets your current requirements but also supports your long-term growth objectives. With the right software in place, you can enhance customer satisfaction, streamline service operations, and ultimately, differentiate your business in a competitive marketplace.

Whether you’re a manufacturer, retailer, or service provider, investing in after-sales service software is an investment in your future success and customer loyalty. Take the time to assess your options, leverage case studies and success stories, and make an informed decision that aligns with your business goals.